Page 6 - ibtekar

P. 6

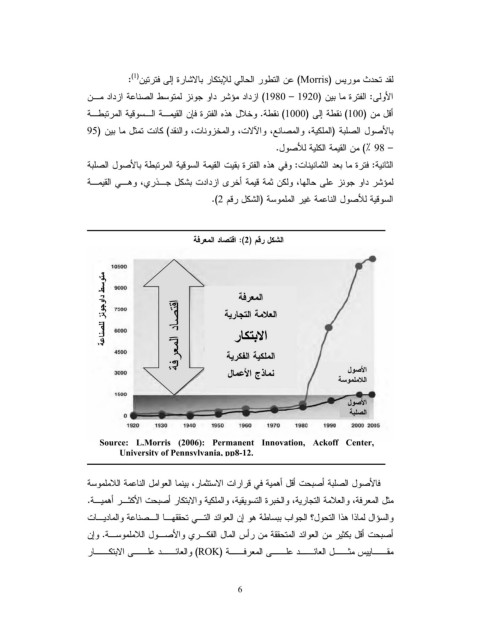

ﻟﻘﺩ ﺘﺤﺩﺙ ﻤﻭﺭﻴﺱ ) (Morrisﻋﻥ ﺍﻟﺘﻁﻭﺭ ﺍﻟﺤﺎﻟﻲ ﻟﻺﺒﺘﻜﺎﺭ ﺒﺎﻻﺸﺎﺭﺓ ﺇﻟﻰ ﻓﺘﺭﺘﻴﻥ):(1

ﺍﻷﻭﻟﻰ :ﺍﻟﻔﺘﺭﺓ ﻤﺎ ﺒﻴﻥ ) (1980 – 1920ﺍﺯﺩﺍﺩ ﻤﺅﺸﺭ ﺩﺍﻭ ﺠﻭﻨﺯ ﻟﻤﺘﻭﺴﻁ ﺍﻟﺼﻨﺎﻋﺔ ﺍﺯﺩﺍﺩ ﻤـﻥ

ﺃﻗل ﻤﻥ ) (100ﻨﻘﻁﺔ ﺇﻟﻰ ) (1000ﻨﻘﻁﺔ .ﻭﺨﻼل ﻫﺫﻩ ﺍﻟﻔﺘﺭﺓ ﻓﺈﻥ ﺍﻟﻘﻴﻤـﺔ ﺍﻟـﺴﻭﻗﻴﺔ ﺍﻟﻤﺭﺘﺒﻁـﺔ

ﺒﺎﻷﺼﻭل ﺍﻟﺼﻠﺒﺔ )ﺍﻟﻤﻠﻜﻴﺔ ،ﻭﺍﻟﻤﺼﺎﻨﻊ ،ﻭﺍﻵﻻﺕ ،ﻭﺍﻟﻤﺨﺯﻭﻨﺎﺕ ،ﻭﺍﻟﻨﻘﺩ( ﻜﺎﻨﺕ ﺘﻤﺜل ﻤﺎ ﺒﻴﻥ )95

– (٪ 98ﻤﻥ ﺍﻟﻘﻴﻤﺔ ﺍﻟﻜﻠﻴﺔ ﻟﻸﺼﻭل.

ﺍﻟﺜﺎﻨﻴﺔ :ﻓﺘﺭﺓ ﻤﺎ ﺒﻌﺩ ﺍﻟﺜﻤﺎﻨﻴﻨﺎﺕ :ﻭﻓﻲ ﻫﺫﻩ ﺍﻟﻔﺘﺭﺓ ﺒﻘﻴﺕ ﺍﻟﻘﻴﻤﺔ ﺍﻟﺴﻭﻗﻴﺔ ﺍﻟﻤﺭﺘﺒﻁﺔ ﺒﺎﻷﺼﻭل ﺍﻟﺼﻠﺒﺔ

ﻟﻤﺅﺸﺭ ﺩﺍﻭ ﺠﻭﻨﺯ ﻋﻠﻰ ﺤﺎﻟﻬﺎ ،ﻭﻟﻜﻥ ﺜﻤﺔ ﻗﻴﻤﺔ ﺃﺨﺭﻯ ﺍﺯﺩﺍﺩﺕ ﺒﺸﻜل ﺠـﺫﺭﻱ ،ﻭﻫـﻲ ﺍﻟﻘﻴﻤـﺔ

ﺍﻟﺴﻭﻗﻴﺔ ﻟﻸﺼﻭل ﺍﻟﻨﺎﻋﻤﺔ ﻏﻴﺭ ﺍﻟﻤﻠﻤﻭﺴﺔ )ﺍﻟﺸﻜل ﺭﻗﻡ .(2

ﺍﻟﺸﻜل ﺭﻗﻡ ) :(2ﺍﻗﺘﺼﺎﺩ ﺍﻟﻤﻌﺭﻓﺔ

ﻤﺘﻭﺴﻁ ﺩﺍﻭﺠﻭﻨﺯ ﻟﻠﺼﻨﺎﻋﺔ ﺍﻟﻤﻌﺭﻓﺔ ﺍﻷﺼﻭل

ﺍﻟﻌﻼﻤﺔ ﺍﻟﺘﺠﺎﺭﻴﺔ ﺍﻟﻼﻤﻠﻤﻭﺴﺔ

ﺍﻗﺘﺼﺎﺩ ﺍﻟﻤﻌﺭﻓﺔ

ﺍﻻﺒﺘﻜﺎﺭ ﺍﻷﺼﻭل

ﺍﻟﺼﻠﺒﺔ

ﺍﻟﻤﻠﻜﻴﺔ ﺍﻟﻔﻜﺭﻴﺔ

ﻨﻤﺎﺫﺝ ﺍﻷﻋﻤﺎل

Source: L.Morris (2006): Permanent Innovation, Ackoff Center,

University of Pennsylvania, pp8-12.

ﻓﺎﻷﺼﻭل ﺍﻟﺼﻠﺒﺔ ﺃﺼﺒﺤﺕ ﺃﻗل ﺃﻫﻤﻴﺔ ﻓﻲ ﻗﺭﺍﺭﺍﺕ ﺍﻻﺴﺘﺜﻤﺎﺭ ،ﺒﻴﻨﻤﺎ ﺍﻟﻌﻭﺍﻤل ﺍﻟﻨﺎﻋﻤﺔ ﺍﻟﻼﻤﻠﻤﻭﺴﺔ

ﻤﺜل ﺍﻟﻤﻌﺭﻓﺔ ،ﻭﺍﻟﻌﻼﻤﺔ ﺍﻟﺘﺠﺎﺭﻴﺔ ،ﻭﺍﻟﺨﺒﺭﺓ ﺍﻟﺘﺴﻭﻴﻘﻴﺔ ،ﻭﺍﻟﻤﻠﻜﻴﺔ ﻭﺍﻻﺒﺘﻜﺎﺭ ﺃﺼﺒﺤﺕ ﺍﻷﻜﺜـﺭ ﺃﻫﻤﻴـﺔ.

ﻭﺍﻟﺴﺅﺍل ﻟﻤﺎﺫﺍ ﻫﺫﺍ ﺍﻟﺘﺤﻭل؟ ﺍﻟﺠﻭﺍﺏ ﺒﺒﺴﺎﻁﺔ ﻫﻭ ﺇﻥ ﺍﻟﻌﻭﺍﺌﺩ ﺍﻟﺘـﻲ ﺘﺤﻘﻘﻬـﺎ ﺍﻟـﺼﻨﺎﻋﺔ ﻭﺍﻟﻤﺎﺩﻴـﺎﺕ

ﺃﺼﺒﺤﺕ ﺃﻗل ﺒﻜﺜﻴﺭ ﻤﻥ ﺍﻟﻌﻭﺍﺌﺩ ﺍﻟﻤﺘﺤﻘﻘﺔ ﻤﻥ ﺭﺃﺱ ﺍﻟﻤﺎل ﺍﻟﻔﻜـﺭﻱ ﻭﺍﻷﺼـﻭل ﺍﻟﻼﻤﻠﻤﻭﺴـﺔ .ﻭﺇﻥ

ﻤﻘــﺎﻴﻴﺱ ﻤﺜــل ﺍﻟﻌﺎﺌــﺩ ﻋﻠــﻰ ﺍﻟﻤﻌﺭﻓــﺔ ) (ROKﻭﺍﻟﻌﺎﺌــﺩ ﻋﻠــﻰ ﺍﻻﺒﺘﻜــﺎﺭ

6